As the 2023 proxy season kicks into high gear, compensation practices, equity plans, and board accountability are top of mind for many investors. Here are four trends that deserve attention:

![]() Increasing Opposition to Directors Based on Executive Compensation Concerns.

Increasing Opposition to Directors Based on Executive Compensation Concerns.

The past two years have seen a renewed focus and interest on the composition of the Board of Directors, with investors assessing whether the mix of skills, experience and personal characteristics create a sufficiently ‘fit-for-purpose’ boardroom.

Concurrent with this heightened focus has been an expansion of director responsibilities, particularly for the compensation committee. Newer responsibilities often include oversight of human capital management, including issues such as DEI and gender pay equity. Many committees are now tasked with aligning compensation with the company’s ESG goals. On top of this, committees are dealing with the effect of market volatility on their ability to effectively incentivize and retain top talent.

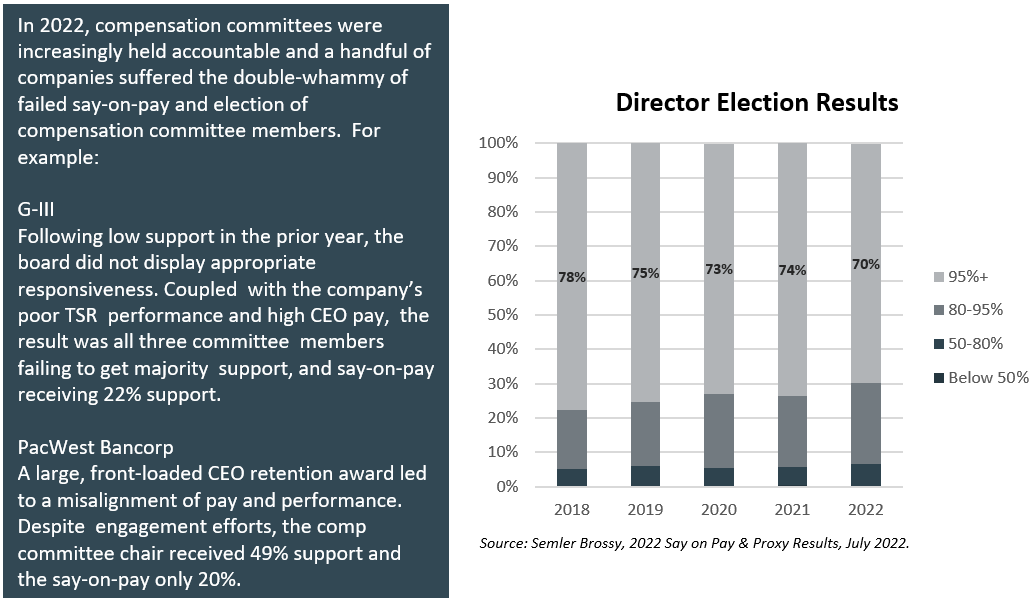

In this environment, it is unsurprising that average director election support has begun declining. More interestingly nearly 30% of directors received between 50-95% support last year, with 57 directors failing to receive majority support. According to a Glass Lewis study, the most common drivers were gender diversity concerns…and compensation concerns.

WHAT TO WATCH: Investors will continue to focus on ‘fit-for-purpose’ board composition, which includes holding directors accountable for perceived missteps on pay structure, pay and performance alignment, and responsiveness to prior low say on pay support. Will investors continue to increasingly vote against individual directors as well as say-on-pay?

![]() More Failed Say on Pay / Increasing Importance of Disclosure and Engagement.

More Failed Say on Pay / Increasing Importance of Disclosure and Engagement.

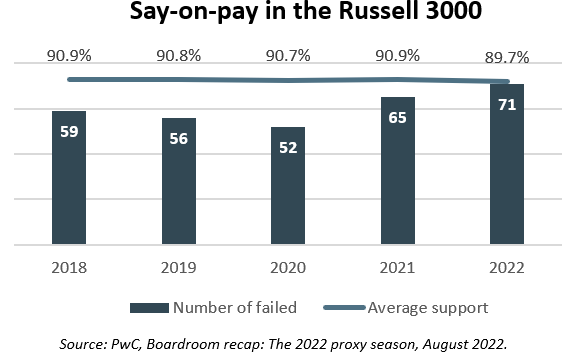

The past two years have seen an increasing investor pushback on pay practices, including a record 71 failed say-on-pay proposals in the Russell 3000 in 2022. The number of companies receiving less than 70% support also increased: nearly 10% in 2022, as compared to 6.8% in 2021. It is clear that investors are more willing than ever to oppose pay plans. Commonly cited issues include pay and performance misalignment, inappropriate or unchallenging performance targets, and the use of one-time/discretionary awards. In fact, 2022 saw a substantial increase in the frequency of one-time awards, including discretionary, promotion, sign-on and retention awards.

Some of these awards can certainly be attributed to compensation committees reacting to challenging macroeconomic conditions – but investors are clearly unwilling to support – or at least much less tolerant – of many of the resultant payments and actions. This trend underscores the growing importance of enhanced CD&A disclosure coupled with a robust year-round shareholder engagement program.

WHAT TO WATCH: Challenging market conditions, including increased market volatility, rising interest rates, and supply chain disruptions, have stress-tested many pay structures and a commitment to pay and performance alignment.Will investors continue to vote against more or more plans, or will strong disclosure of these mitigating factors – and the committee’s responses – save the day?

![]() Pay Versus Performance – Creating more questions than answers?

Pay Versus Performance – Creating more questions than answers?

While this new disclosure is intended to greatly improve transparency and standardize the calculations and presentation of pay and performance data, the effectiveness may still be questioned – theses calculations are complicated, particularly of Compensation Actually Paid (CAP). In early filings, we have already seen the complications – negative CAP values; no company-selected financial measure; changing peer groups from year to year. Ideally, this disclosure leads to better-informed voting decisions. But does it?

Approximately 65% of early filers have an accumulated CAP greater than or equal to their Summary Compensation Table (SCT) total pay, according to recent observations from Infinite Equity. Approximately 1/3 of those companies have underperformed their peers in TSR over that same 3-year period. Will investors use this disconnect to cast votes against say-on-pay proposals, compensation committee members, and/or equity plans?

WHAT TO WATCH: The usefulness of this disclosure with be determined by the market. Do investors feel better informed? How quickly will investors use this new disclosure to push back at companies that appear to be outliers?

![]() Increased Equity Plan Scrutiny.

Increased Equity Plan Scrutiny.

For many years, investors have been very willing to broadly support equity plans, as the use of equity compensation is generally seen as an alignment of employee and executive interests with the interests of shareholders. 2022 was not particularly different: only two Russell 3000 companies failed to receive majority support, and average support levels remained consistent with prior years.

This has always been unaligned with ISS and Glass Lewis: in 2022, ISS recommended against nearly 27% of all equity plan proposals, and Glass Lewis recommended against 14%. However, two companies have already failed in 2023, and average support levels are down to 86.8% (compared to 89.6% in 2022). Will 2023 see a shareholder revolt (relatively speaking) with equity plans?

Across the market, declining share prices over the past year created dilution and share availability issues, causing companies to rethink equity practices and potentially creatively manage equity burn rates (shift to cash? Lower grant sizes? Change mix of awards?). For many companies, creative considerations were not possible – which potentially has put more companies in a precarious situation: needing shares to replenish their equity plan, but bumping into the dilution and plan cost thresholds of proxy advisors and large investors. In the coming months, many companies will need to strategically engage with their shareholders to win support for their equity plans.

WHAT TO WATCH: Although very few equity plans each year fail to receive majority support, there have already been two failures in the first three months of 2023. Given the challenging market conditions of the past year, large grants to executives have been increasingly costly and highly dilutive. Will this be the year that investors push back?