It’s early innings for Proxy Season 2023, set against wild market volatility, heated debates over ESG, and ever-evolving investor expectations. Here’s what we’re watching:

![]() Governance and risk management in focus.

Governance and risk management in focus.

Over the past year, many investors have reminded the world that ESG begins with ‘G’ and that material risks should be overseen by comprehensive enterprise risk management and fit-for-purpose Board and committee oversight. Recent corporate collapses – including the much-publicized bank failures – have only intensified this lesson: sound governance and risk management are foundational to long-term business success. Companies that fail on both of these fronts are also quite likely to fail in delivering on their long-term strategies.

WHAT TO WATCH: ‘G’ concerns do not always translate neatly into ‘ordinary course’ Annual Meeting results; however, negative impressions have lasting impact. What governance concerns of today will drive tomorrow’s proxy fights?

![]() ESG backlash having mixed impacts.

ESG backlash having mixed impacts.

Anti-ESG political leaders in conservative states and anti-ESG investors such as Strive Asset Management have generated significant media coverage and impacted the ESG dialogue in the US.

It is unlikely that the anti-ESG movement will draw much shareholder support through shareholder proposals or proxy fights. As an example, at Apple’s recent meeting, an anti-ESG proposal on adverse impacts of DE&I efforts on non-diverse employees received just 1.4% support.

It is unlikely that the anti-ESG movement will draw much shareholder support through shareholder proposals or proxy fights. As an example, at Apple’s recent meeting, an anti-ESG proposal on adverse impacts of DE&I efforts on non-diverse employees received just 1.4% support.- However, it does appear that the ‘backlash’ is impacting large institutional investors’ decision-making. We are seeing a heightened investor emphasis on materiality-based ESG, and a strong reticence to endorse blanket box-checking or anything that could constitute ‘greenwashing’. We are also seeing large investors re-calibrate their advocacy efforts, emphasizing the importance of disclosure and, in certain instances, underscoring that it is not the role of minority shareholders to dictate corporate strategy.

WHAT TO WATCH: Will large shareholders be more hesitant to support shareholder proposals or ‘vote no’ campaigns that seek to dictate an E or S outcome (or are otherwise too ‘prescriptive’)? Conversely, will shareholders raise the bar on ‘neutral’ matters such as disclosure, governance and executive compensation? And, on the other side of proxy season, will investors’ voting and engagement activities garner scrutiny from either – or both – sides of the political aisle?

![]() Another flood of shareholder proposals.

Another flood of shareholder proposals.

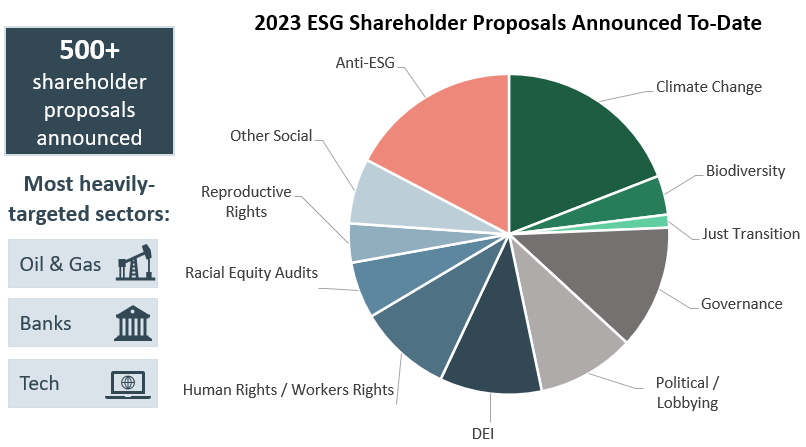

Early indicators are that the number of 2023 proposals will near the record high reached in 2022. Climate and DE&I (including racial justice) are the largest focus areas, but proposal topics range broadly and include biodiversity/pollution, worker rights, human rights, and lobbying/political activities.

- On some E&S proposals, such as those calling for enhanced DE&I disclosure, many companies and proponents have made mutual efforts to settle rather than to go to a vote. This generally starts early with engagement, with both sides taking a solutions-oriented approach rather than an adversarial bent – to settle proposals on matters where there is momentum in the market and where higher shareholder support levels could be expected.

- At the same time, many E&S proposals appear to be asking for more granular disclosure, tailored more closely to company-specific circumstances, and – in many instances – targets or actions that align with a specific outcome. With less room for compromise, many will go to a vote.

WHAT TO WATCH: Where will the largest investors draw the line in terms of a proposal being ‘too prescriptive’? Will investors raise the bar on issues frequenting the front pages, such as labor practices (e.g., a proposal at Starbucks seeking a third-party assessment of the company’s adherence to worker rights commitments garnered 52% support this past week)?

Sources: ICCR; As You Sow; Proxy Impact; company filings and other public reports

![]() Investor views are increasingly diverging.

Investor views are increasingly diverging.

- Recognizing the business realities of an economic downturn and market volatility – and feeling significant regulatory pressure of their own from US policymakers (see #2 above) – large institutional investment firms continue to moderate their positions and clarify that they are focused on good governance, risk management, and the long-term financial bottom line.

- Additionally, large firms including BlackRock, Vanguard and State Street Global Advisors are in various stages of implementing “voting choice” programs to provide institutional and retail clients with the ability to direct votes associated with their investments, rather than rely entirely on the asset managers’ stewardship teams. In theory, these programs could significantly splinter or shift how these sizable stakes have historically voted. However, in practice, the near-term impact appears quite limited.

- At the same time, ESG activists seek opportunities to further increase pressure on companies. These ESG activists are leveraging large investor coalitions (e.g., Climate Action 100+) to advance their agenda, and are more willing to threaten extreme action, such as ESG-focused campaigns against directors.

- European investors, US pension funds and other progressive investors have signaled an increased willingness to vote against directors due to perceived failures on climate matters.

WHAT TO WATCH: How will companies navigate conflicting investor viewpoints and demands? Will mainstream members of investor coalitions balk at the more aggressive demands of ESG activists? Will ‘voting choice’ have an impact on voting results?