The 2022 proxy season was framed by the collision of two forces: momentum from the record-breaking, ESG-driven shareholder revolts during the 2021 proxy season, running up against an energy crisis, rates of inflation not seen since 1981 and a global economic slowdown. In casting their votes at this year’s shareholder meetings, investors were left to grapple with whether short-term pressures should take precedent over long-term systemic risks.

Against this backdrop, it is no surprise that 2022 proxy voting results created mixed messages and left room for interpretation. A few key takeaways that companies should keep in mind from the start:

#1: Investors are increasingly open to ‘khaki’ solutions. We see increasing investor appreciation that there is no ‘one-size-fits-all,’ straightforward solution to the most challenging E&S issues. This shift was signaled earlier this year, as Blackrock CEO Larry Fink’s annual letter acknowledged that the world “need[s] to pass through shades of brown to shades of green” in navigating the energy transition. This newfound focus on ‘khaki finance’ provides companies with opportunities to gather shareholder support for sustainability strategies that are both ambitious and pragmatic.

#2: ESG is not dead. The perfect storm of a bear market, the energy crisis and investigations into investor “greenwashing” have given rise to headlines such as “ESG exposed in a world of changing priorities” and “RIP ESG”. In reality, investors are not moving away from ESG, and are deepening the breadth and depth of their analysis. We expect that investor ESG analysis will evolve toward more nuance and rigor and that simplistic, bright line approaches to ESG will be the only mortalities coming out of this period of enhanced scrutiny. Indeed, shareholders drove record-high support for a range of environmental and social (E&S) proposals, even as they became more discerning on others.

#3: Investor ‘off-season’ engagement remains essential. Shareholders and their proxy voting teams were busier than ever in 2022, and companies found it more difficult than ever to get shareholder attention in the heat of proxy season. Companies that had regular discussions with their largest investors during prior ‘off seasons’ were better positioned to explain their nuanced ESG dilemmas, including the real-world implications of a prescriptive shareholder proposal, the company-specific merits of their pay design, or the behind-the-scenes strengths of individual directors. There is no substitute for real shareholder dialogue, and 2022 hammered home that point.

SHAREHOLDER PROPOSALS

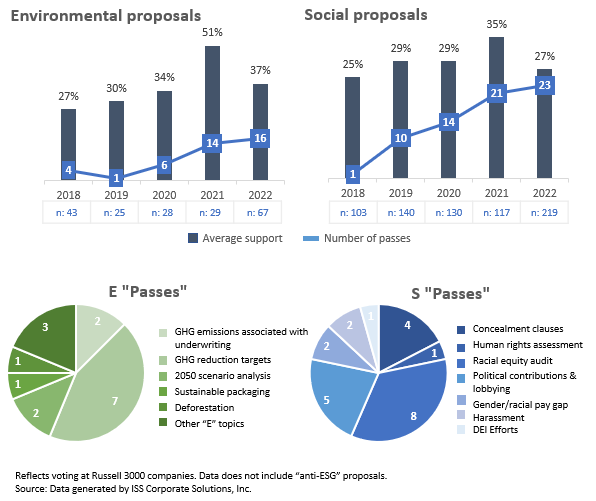

- ESG activists and other shareholders filed a flood of E&S-related proposals: nearly 600, up significantly from the high-water mark set in 2021. Moreover, the SEC was increasingly unwilling to allow companies to exclude proposals from the ballot.

- However, average support and passage rates for environmental and social (E&S) shareholder proposals declined significantly.

- The support level decline requires some unpacking, however, as it was driven in large part by:

- Companies negotiating dozens of withdrawals of proposal types that received high support in 2021, rather than risk adverse votes.

- Many proposals – particularly those focused on climate-related targets – sought specific strategic action, rather than just additional disclosure, and were viewed as too “prescriptive”.

- Conversely, proposals seeking additional disclosure and oversight of social justice matters – most notably racial equity audits – received higher support, a trend we expect to continue in the future.

DIRECTOR ELECTIONS

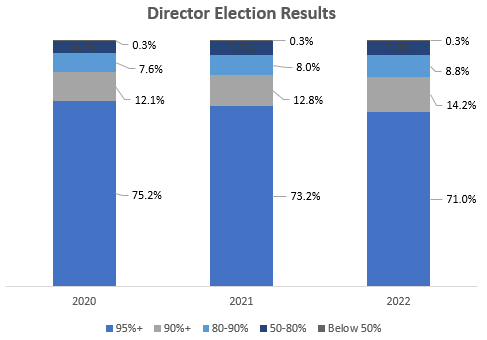

- The vast majority of directors continued to garner high support, although the number of directors receiving top-level, 95%+ support continued to decline.

- After successive years of investors tightening their voting policies, most votes against directors continue to be triggered by perceived governance (e.g., overboarding) and compensation (e.g., multiple years of low Say-on-Pay support) concerns.

- Investors signaled increased focus on climate and diversity accountability in the lead-up to proxy season. In the end, this was not widespread: votes against directors came primarily from European and sustainability-oriented investors and were limited to relative laggards, and select sectors.

SAY-ON-PAY

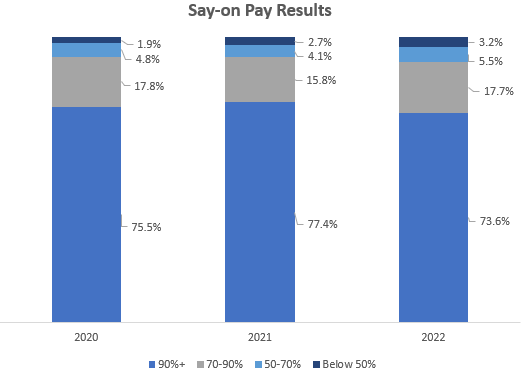

- Say-on-Pay proposals receiving >90% support declined year-over-year, and a higher rate of votes entered the ‘danger zone’ of <70%. Average say-on-pay support also saw a slight decline.

- ISS recommended “Against” more Say-on-Pay votes this year than in 2021 (13.2% vs. 11.9%).

- Quantitative misalignment of relative pay-for-performance and problematic pay practices (e.g., one-time grants) continue to be main drivers of low support.

- Beyond the data, many investors seemed less willing to depart from proxy advisor “Against” recommendations, particularly if the company had low support in the prior year and had not pursued genuine shareholder engagement.

ACTIVISM

- Shareholder activism significantly increased year-on-year, although much activity has been resolved – often with significant company concessions – without going public.

- After 2021’s ‘proxy fight of the century’ at ExxonMobil, many market watchers predicted a wave of ESG-driven proxy fights. This did not come to pass[1], and it remains unclear how receptive top investors will be to ESG-centric campaigns. However, the coming years promise to provide more examples of ESG-infused proxy fights: ESG activists are eyeing opportunities opened by the new universal proxy card rules, and traditional hedge fund activists continue to build their ESG expertise (and arsenal).

[1] In our view, Carl Icahn’s much-publicized, landslide loss against McDonald’s is not a helpful precedent. It is essential to separate ‘values’ from ‘value’ in gauging investor appetite for ESG-driven attacks; very few institutional investors have been focused in recent years on the use of gestational crates for pigs as meaningful to long-term financial value. We anticipate different outcomes as activists choose attacks based on sustainability issues that are broadly viewed as financially material (see, e.g., SASB’s materiality map).